Brilliant Tips About How To Become Cpa In Ny

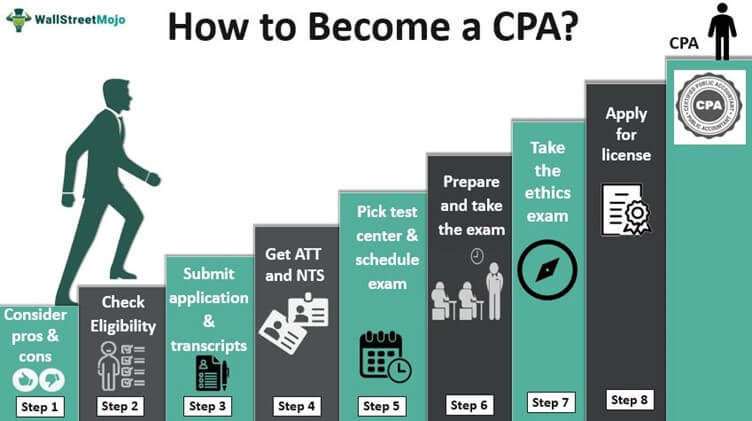

Study for and pass the cpa exam.

How to become cpa in ny. In order to apply for a cpa license in new jersey, you must have one year of experience in the practice of public accounting or its equivalent, under the direction of a licensee. Meet the education requirements to sit for the cpa exam. Aspiring future cpas will need to complete the following minimum cpa requirements to take the cpa exam and become a licensed certified public accountant in new york:

Complete a graduate degree in accounting. New york state recognizes the uniform cpa exam, prepared and graded by the aicpa and administered in new york by cpa examination services, a division of nasba. You must complete one of the following requirements:

How do you become a licensed cpa? Request free info from schools and choose the one that's right for you. Must include courses in financial.

You need at least 120 credits in accounting to become a cpa in new york. If you want to make more money, you need to be a very senior cpa and work in a big city. Ad get real cpa exam questions and comprehensive explanations.

Here are some tips for becoming a cpa successful in new jersey: Ad find online colleges & universities that prepare you for cpa certification. Roger's energy + uworld's revolutionary qbank will help you get to the finish line.

New york cpa exam education requirements. 24 contact hours concentrated in one of the recognized subject areas or. Complete a 150 semester hour accounting program designed to meet the state requirements and approved by the nysed.

![New York Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/New-York-CPA-Experience-Requirements.jpg)

![New York Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/New-York-CPA-Exam-Education-Requirements.jpg)

![2022] How To Become A Cpa In New York. 10 Critical Steps](https://www.superfastcpa.com/wp-content/uploads/2022/04/how-to-become-a-cpa-in-new-york-1024x576.png)

![New York Cpa Requirements - [ 2022 Ny Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/new-york-cpa-exam-requirements.jpg)

![New York Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/New-York-CPA-Exam-Required-Documents-1.png)

![2022] New York Cpa Exam & License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/03/New-York-CPA-Requirements.png?fit=640%2C400&ssl=1)

![2022] How To Become A Cpa In New York. 10 Critical Steps](https://www.superfastcpa.com/wp-content/uploads/2022/04/iStock-1365436662.jpg)

![New York Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/New-York-CPA-Exam-License-Requirements.jpg)